When the Federal Reserve raises interest rates, the stock market often reacts with volatility, presenting both challenges and opportunities for investors. Understanding how different sectors and asset classes respond to rate hikes can help you make informed decisions and adjust your portfolio accordingly. In this article, we’ll explore key stock market trends to watch after a rate hike and provide actionable insights to navigate this shifting landscape.

How Interest Rate Hikes Impact the Stock Market

Interest rate hikes are a tool used by central banks to control inflation, but they also have a ripple effect across financial markets. Here’s how they influence stock prices:

- Higher borrowing costs: Companies with high debt levels may see reduced profitability as financing becomes more expensive.

- Consumer spending shifts: Higher rates can slow discretionary spending, affecting retail and consumer-driven sectors.

- Valuation adjustments: Growth stocks, which rely on future earnings, often underperform as higher rates reduce the present value of those earnings.

- Bond market competition: Rising yields make bonds more attractive, potentially drawing money away from equities.

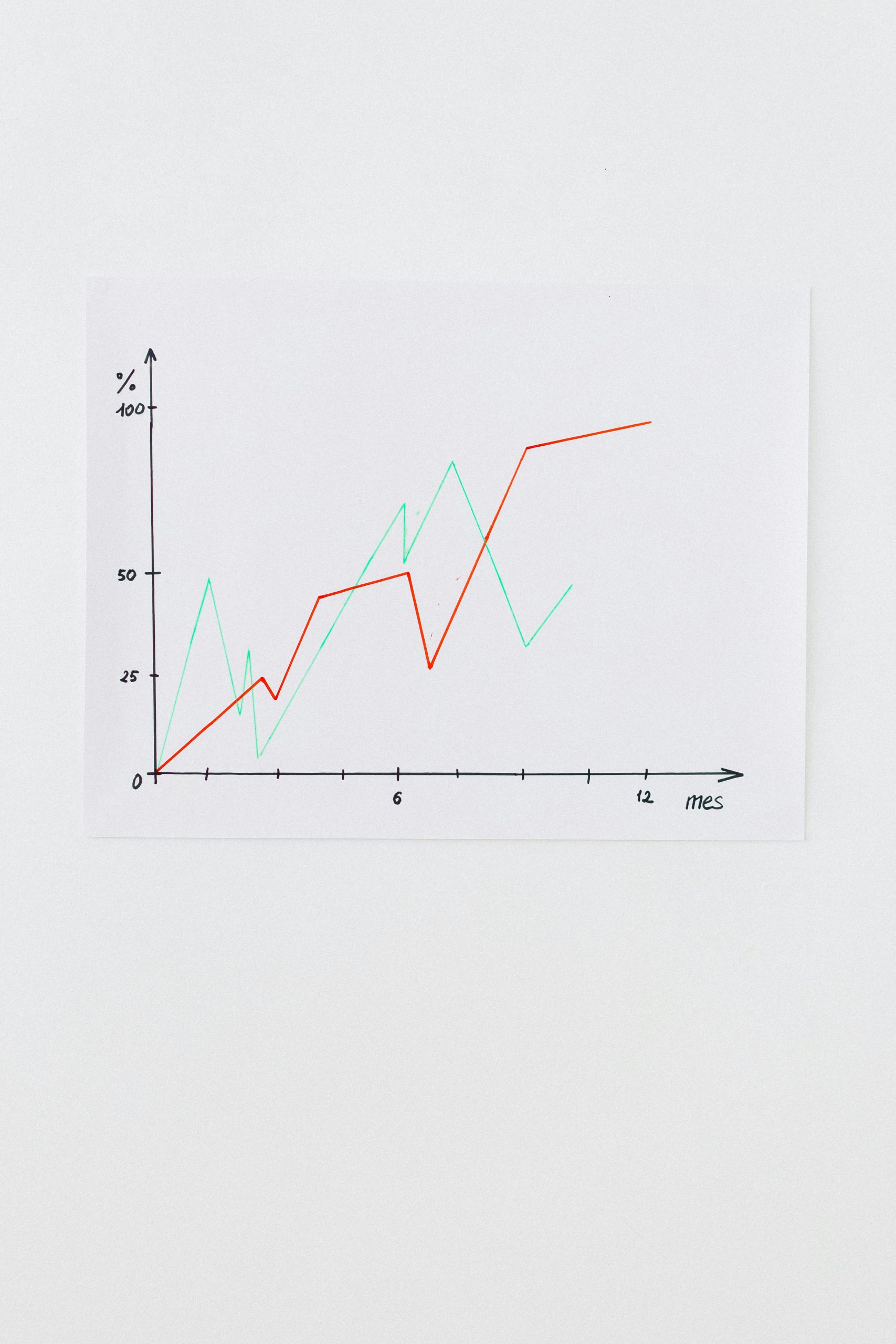

Historically, the initial reaction to a rate hike is often negative, but markets tend to stabilize as investors adjust to the new environment.

Sectors That Typically Outperform After a Rate Hike

Not all sectors react the same way to rising interest rates. Some industries are better positioned to thrive in a higher-rate environment:

Financials

Banks and financial institutions benefit from wider net interest margins—the difference between what they earn on loans and what they pay on deposits. As rates rise, profitability in this sector often improves.

Energy

Energy stocks, particularly oil and gas companies, tend to perform well during inflationary periods. Higher rates often coincide with strong commodity prices, boosting earnings.

Consumer Staples

These companies provide essential goods, making them less sensitive to economic slowdowns. Investors often flock to defensive sectors like consumer staples during uncertain times.

Utilities (With Caution)

While utilities are traditionally seen as defensive plays, their high debt levels can make them vulnerable to rising rates. However, regulated utilities with stable cash flows may still hold up well.

Sectors That May Struggle Post-Rate Hike

Some industries face headwinds when interest rates climb. Investors should monitor these sectors closely:

Technology and Growth Stocks

High-growth tech companies, especially those with negative earnings, often see their valuations compressed as higher rates reduce the appeal of future cash flows.

Real Estate

Higher mortgage rates can slow housing demand, impacting homebuilders and REITs. Commercial real estate may also face pressure due to rising financing costs.

Consumer Discretionary

Companies selling non-essential goods, such as luxury items or travel services, may see reduced demand as consumers tighten their budgets.

Strategies for Investors Navigating a Rising Rate Environment

Adapting your investment approach can help mitigate risks and capitalize on opportunities after a rate hike. Consider these strategies:

- Diversify across sectors: Balance exposure between cyclical and defensive stocks to reduce volatility.

- Focus on quality: Look for companies with strong balance sheets, low debt, and consistent cash flows.

- Consider dividend stocks: Mature companies with reliable dividends can provide income stability in uncertain markets.

- Monitor inflation hedges: Assets like gold, commodities, and TIPS (Treasury Inflation-Protected Securities) may offer protection.

- Stay flexible: Be prepared to adjust your portfolio as economic conditions evolve.

Conclusion

While rate hikes introduce uncertainty, they also create opportunities for savvy investors. By understanding how different sectors respond to rising rates and adjusting your strategy accordingly, you can position your portfolio for long-term success. Keep an eye on economic indicators, Fed communications, and corporate earnings to stay ahead of market trends. Remember, disciplined investing and a well-balanced approach are key to navigating changing financial landscapes.